Nyheder

26.03.2025

CBS LAW Nyhedsbrev

24.04.2024

Sarah Maria Denta presented on strategic contracting and climate law at a green public procurement workshop

Arrangementer

Forum for Tax Law

Introduction to the Forum for Tax Law

Forum for Tax Law facilitates collaboration between the faculty affiliated with tax law at CBS LAW. The main purpose with the Forum is to coordinate and showcase the broad variety of tax law activities that make up CBS LAW, which includes teaching, dissemination, research, and events concerning tax law. As it appears below, the Forum group members teach in a wide range of tax law courses that are offered across various CBS programmes. Apart from teaching at CBS, they also arrange national as well as international conferences and seminars, they participate in and disseminate at research seminars both nationally as well as internationally, and they publish research in widely acknowledged research journals.

Members of the Forum:

Events

CBS Futures of Tax

Friday, February 21 at 9:30 a.m. CET, in person and online

We are delighted to invite you to the inaugural session of Future of Tax with Siddhesh Rao. In this event series, Siddhesh Rao and prominent tax experts explore pressing tax issues impacting governments, businesses, and academia. The aim of the Future of Tax is to foster inclusive policy debates, encouraging diverse perspectives from various fields.

Click here for a video presentation about the event

Guest

Prof. Pascal Saint-Amans

Partner at Brunswick, ex-Director, OECD Centre for Tax Policy and Administration at OECD – OCDE, Associate Professor HEC Paris

Venue:

Copenhagen Business School,

Solbjerg plads 3, Room SPs 08, 2000 Frederiksberg

Please register at: https://cbs.nemtilmeld.dk/1130/

We look forward to your participation!

Dr. Siddhesh Rao, LL.M (WU), Post Doc

Professor Peter Koerver Schmidt

Professor Jane Bolander

Previous Events

TaxTalk 29. Maj

Onsdag den 29. maj 2024 fra 16.00 til ca. 18.15 i auditorium C.0.33, stueetagen ved hovedindgangen til Dalgas Have 15, Frederiksberg.

Der vil indledningsvist være en kort præsentation af to nye fag på Master i Skat.

Efter introduktion til emnet ved studieleder, Professor Jane Bolander, vil TaxTalk stille skarpt på nogle centrale områder,bl.a. følgende:

• Bevis i skatte- og skattestrafferetten

• Bevis for fradragsberettigede udgifter til forsøg og forskning

• Særlige bevisbyrdemæssige udfordringer

OPLÆGSHOLDERNE ER:

- Professor, dr.jur. Jan Pedersen, Aarhus Universitet

- Partner Jakob Krogsøe, Advokatfirmaet Gorrissen Federspiel

- Partner Steffen Sværke, Advokatfirmaet Poul Schmith/Kammeradvokaten

- Professor, lic.polit, Michael Møller, Department of finance, CBS

Danish-Swedish Tax Network 2024

CBS skal i år være vært for Danish-Swedish Tax Network 2024 fra den 19-20 august.

Hovedemnerne vil være skæringslinjen mellem skatteret og entrepreneurship. Dertil vil der også være tid til at høre om skattenyheder fra både Danmark og Sverige og nye PhD projekter.

Du kan finde programmet her: ![]() Program

Program

Slides fra netværksdagen:

![]() Jeroen Lammers og Peter Koerver Schmidt

Jeroen Lammers og Peter Koerver Schmidt

![]() Jeroen Lammers og Peter Koerver Schmidt 2

Jeroen Lammers og Peter Koerver Schmidt 2

CBS Annual International Tax Conference 2024

Join us at CBS LAW for the CBS Annual International Tax Conference 2024 on 21 November. This year’s conference will explore from a Nordic perspective, how to navigate recent tax policy developments while pursuing Nordic-style growth—a model characterized by social inclusivity, sustainable practices, and market competitiveness, with an emphasis on trust, welfare, and overall well-being.

The recent EU report on “The Future of European Competitiveness” gives off a clear warning signal: European growth has been slowing since the beginning of the 21st century. Since 2000, real disposable income growth in the United States has been double that of the European Union. In the same period, the innovation gap between the US and the EU has widened, and the EU has become more geopolitically vulnerable due to its dependency on other countries in strategic areas. The report highlights the critical need for investment in growth to overcome these challenges and to prevent the EU falling further behind.

At the same time, over the last 20 years many new national and international tax rules have been introduced. Many of these tax measures have either had as their goal to discourage certain practices, to prevent abuse and avoidance, or to introduce extra reporting and disclosure requirements. As such, these developments in tax might be seen to run counter to achieving growth in the EU.

Our conference will address challenges posed by recent tax developments in light of Europe's slowing growth and provide insights on whether the recent tax developments may prove an asset to achieving Nordic-style, sustainable and inclusive growth.

The event will feature presentations and panel discussions by leading experts and practitioners who will address this theme from their own unique vantage point. The speakers include:

- Philip Baker KC (Field Court Tax Chambers and University of Oxford)

- Dirk Jan Sinke (Dutch Business Confederation)

- Jakob Bundgaard (Corit Advisory)

- Elin Sarai (NHH Norwegian School of Economics)

You can see the entire presentation ![]() here.

here.

This is an excellent opportunity to connect with colleagues in tax law and gain insights from top professionals in the field. We welcome participants from the private sector, public authorities, and academia. We especially invite CBS students to be a part of this event on how to drive inclusive and sustainable growth in the Nordics.

The event will run from 13:00 to 17:00 at Copenhagen Business School, Solbjerg Plads 3 (Auditorium SPs14), followed by a reception for further networking.

You can sign up for the event here.

Seminar 15 December: 'Harmonising treaty-based anti-tax avoidance' with Visiting PhD Scholar Evan Collins

In this seminar, Evan Collins, will outline how a comparative view of general anti-avoidance rules can help us to understand the challenges to harmonising the Principal Purpose Test (PPT), a treaty-based general anti-avoidance rule (GAAR) which is now included in many tax treaties. The seminar will reflect on the text, design and purpose of the PPT, as well that of the GAARs from New Zealand and Canada, and recent case-law developments from these countries.

Bio:

Evan Collins is a Doctoral Student in Financial Law at the Faculty of Law at Lund University. His research seeks to analyse the Principal Purpose Test (PPT) a general anti-avoidance rule incorporated into many double taxation agreements as a result of the OECD Base Erosion and Profit Shifting project. The method of analysis is comparative law, and through researching the general anti-avoidance rules of New Zealand, Canada, Ireland and the United Kingdom, the goal of the research is to understand how the PPT might be applied within different states, and what challenges there may be to harmonizing the PPTs application across signatory states.

CBS Annual International Tax Conference 2023

The conference took place on 15 November 2023.

For program information.

You can find the full presentation here:![]() annual_cbs_international_tax_conference_2023_final.pdf

annual_cbs_international_tax_conference_2023_final.pdf

PhD Seminar with Visiting PhD Scholar Caroline Thomsen - 17 August 2023

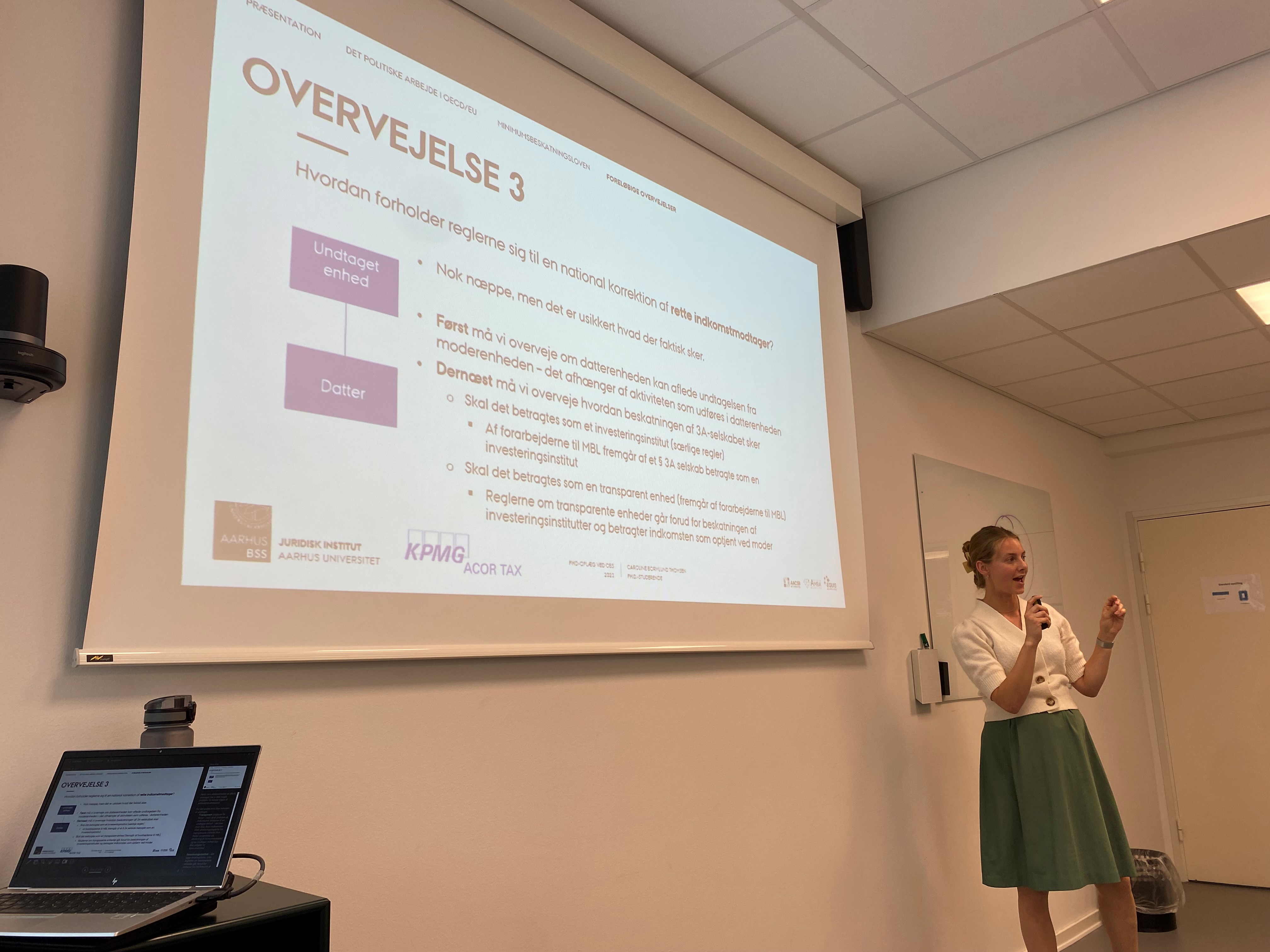

Visiting PhD Scholar Caroline Thomsen – 'Implementeringen af reglerne om global minimumsbeskatning'.

You can find the full presentation here.

TaxTalk 2023 -- Skatteretten er et masseafgørelsesområde, hvor en række spørgsmål skal afgøres for et stort antal skatteydere. På grund af den store mængde kan ikke alle forhold individuelt behandles af fysiske personer. Der er store økonomiske gevinster ved at få mange af disse sager automatiseret. Automatiseringen vil imidlertid presse nogle borgeres retssikkerhed, idet ikke alle har samme forhold og forudsætninger – men hvor går grænsen?

Tidspunkt: Onsdag den 10. maj 2023 fra 16.00 til ca. 18.00 i auditorium C.0.33, stueetagen ved hovedingangen til Dalgas Have 15, Frederiksberg.

Information: https://efteruddannelse.cbs.dk/master/programmer/master-i-skat/events/taxtalk-2023.

-

On 23 November 2022, we hosted the 2022 CBS Annual International Tax Conference on the topic of 'Climate Change and Tax Instruments -- How can tax law contribute to the green transition?', which included External Lecturer Jeroen Lammers as a speaker and was chaired by Professor Peter Koerver Schmidt.

-

On 14 June 2022, Professor Jane Bolander coordinated and hosted the event TaxTalk 2022: Efterrettelighed i gråzoneland (Compliance in grey zones) as part of the study program Master in Tax. Jane introduced the topic of the event in order to prime the participants for the subsequent interesting talks delivered by tax consultants and representatives from the Danish Ministry of Taxation.

-

On 31 March 2022, Professor Jane Bolander coordinated and hosted the event 'Masterclass' in connection to the master's programme Master i Skat.

Dissemination

Assistant Professor Jeroen Lammers has been featured in the news article EU Energy Tax Reform Highlights Limits of Passerelle Clauses in Tax Notes International Vol 116, 2 December 2024 explaining that the use of the passerelle clause (article 192 TFEU) in conjunction with article 113 TFEU as a legal basis for the Energy Tax Directive is rather curious. The article can be accessed here.

- The postgraduate programme Master i Skat has been extended to include a course on ‘International Corporate Tax Policy’, which will be taught by Assistant Professor Jeroen Lammers starting Spring Semester 2024. You can read more about the new course and register here.

- From 6-8 June, Professor Peter Koerver Schmidt participated in the annual congress of the European Association of Tax Law Professors (EATLP). This year the congress took place at the University of Antwerp, and the overall topic was “Taxation and Inequalities”. Peter had — together with Assistant Professor Louise Blichfeldt Fjord — prepared the national report for Denmark. Peter also participated in a panel discussion on “Tax Policy and Inequality” and made a presentation on the topic of “Taxation and intergenerational justice”. You can access his slides here:

Taxation and Intergenerational Equity.pdf

Taxation and Intergenerational Equity.pdf - On 29 June 2024, Assistant Professor Jeroen Lammers presented his article, "Breaking the Double Tax Paradigm," co-authored with Assistant Professor Tarcisio Diniz Magalhaes from the University of Antwerp. The article can be found in the IBFD World Tax Journal (Vol. 16, No. 1, 2024). This presentation took place at the Annual Academic Symposium hosted by the Oxford University Centre for Business Taxation from 27 to 29 June 2024.

- New text book release by Peter Koerver Schmidt; Michael Tell; Katja Dyppel Weber / International skatteret : I et dansk perspektiv. 3 edition. Copenhagen: Hans Reitzels Forlag 2024

- 4 December, Professor Peter Koerver Schmidt did a presentation regarding the European Commissions’ BEFIT proposal (Business in Europe: Framework for Income Taxation), COM(2023) 532 final at the FSR – Danish Auditors’ annual conference on International Tax Law. You can access the presentation here.

- 4 December, Assistant Professor Jeroen Lammers presented his PhD research on 'the Spirit of International Tax Law' at the FSR – Danish Auditors’ annual conference on International Tax Law. You can access the presentation here.

- 7 November, Assistant Professor Jeroen Lammers presented as national reporter of DAC7 at The Amsterdam Centre for Tax Law (ACTL)'s Conference on " EU Tax Reporting for Digital Platforms (DAC7): Comparing Member States' Approaches ".

- 12 October, Professor Peter Koerver Schmidt visited the Danish Tax Agency’s offices in both Copenhagen and Aarhus to present and discuss difficult issues related to the interpretation and application of the Danish rules on taxation of controlled foreign corporations (the “CFC rules”). You can access his presentation here.

- 5 October, Professor Peter Koerver Schmidt presented at the Tax Law Conference 2023 – Contemporary Issues at the Faculty of Law at the University of Bergen and the Norwegian School of Economics.You can access his presentation here: presentation_comparison_nordic_gaar_-_final_pdf.pdf

- 6 September, Assistant Professor Jeroen Lammers presented at the TRN Conference 2023 at the Faculty of Law, University of Cambridge. Jeroen's presentation was titled 'Improving Tax Treaties by Allowing Limited Double Taxation' and can be accessed here: improving_tax_treaties_cambridge_06.09.2023_final.pptx

- 21 August, Professor Peter Koerver Schmidt talked about 'Article-based thesis or monograph? Choice of format in a digital era' at the Danish/Swedish Tax Network's annual seminar at Örebro University in which multiple members of the CBS LAW Forum for Tax Law participated. You can find the full presentation here: dansk-svensk_skattenetvaerk_2023.pdf

- 21 June, Assistant Professor Jeroen Lammers succesfully defended his PhD thesis titled the Spirit of International Tax Law: From Fiscal Virtue to Mission-Oriented Moon-Shot at University of Amsterdam.

- 30 May - Assistant Professor Louise Blichfeldt Fjord was co-coordinator of the Young IFA Network's (YIN) tax law event titled 'Konference om skattepolitik, lobbyisme og rollen som en skattepolitisk interesseorganisation' (Conference on tax policies, lobbyism and the role of tax policy interest groups).

- 15 March - External Lecturer Jeroen Lammers presented at the WTS Global conference on Tax, Sustainability & Leadership with a presentation titled 'the case for international tax policy coordination and constructive business engagement in the fight again climate change

- 2 March - Assistant Professor Louise Blichfeldt Fjord was co-coordinator of the Young IFA Network's (YIN) tax law event titled 'EU's prioriteter på skatteområdet og den seneste udvikling' (The EU's taxation priorities and recent developments').

- 17 November, Professor Peter Koerver Schmidt presented at FSR–Danske Revisorer’s Annual Conference on International Tax Law. Peter’s presentation dealt with recent developments with respect to rules on taxation of income in controlled foreign companies.

- 21 September, Professor Peter Koerver Schmidt presented at the Swedish branch of the International Fiscal Assocation (IFA) in University of Gothenburg. In his presentation, Peter spoke about the legal and moral obligations with respect to corporate taxation.

- 22 August, Associate Professor Michael Tell and Assistant Professor Louise Blichfeldt Fjord presented the main findings of the IFA General Reports 2022 at the Danish branch of the International Fiscal Association (IFA).

- 28 June, Professor Peter Koerver Schmidt was invited as a discussant at the Academic Symposium held in Oxford and organized by the Oxford University Centre for Business Taxation.

- 24 June, Professor Peter Koerver Schmidt and Assistant Professor Louise Blichfeldt Fjord jointly presented on ‘Digital Transformation and the Taxation Systems’ at the University Carlos III of Madrid conference titled ‘Digital Transformation of Government: Towards a Digital Leviathan?’

- 30 May - Professor Peter Koerver Schmidt hosted a seminar at Göteburg University, Sweden, on the topic of ”Legal Pragmatism – A Useful and Adequate Explanatory Model for Danish Adjudication on Tax Avoidance?” Link to the article hereto. For more information about the seminar, click here.

- 6 May - Professor Peter Koerver Schmidt contributed on the topic of legal and economic consequences of tax avoidance at the University of Reykjavik. His talk is titled 'Paying corporate tax -- an ethical and/or legal obligation'. Link to the event and research group.

- 21 April, PhD Fellow Maria Wriedt Keller held a WIP seminar in connection to her research titled ‘R&D Tax incentives, from a Danish and International perspective’.

- 1 April - Professor Peter Koerver Schmidt was invited to be part of preparing a new report for the Danish Tax Law Council, which focuses on "the third group" in the labour market. The report proposes various new measures for how the tax rules can be adjusted to accommodate this particular group.

- 31 March - Professor Peter Koerver Schmidt presented as a guest lecturer at the University of Padova on the topic of 'CFC legislation in a comparative perspective'.

-

31 March - Professor Jane Bolander hosted a seminar titled ‘Masterclass’ event in connection to the programme Master in Tax.

-

10 March - Assistant Professor Louise Blichfeldt Fjord was the moderator of a panel discussion on ‘The future of taxation of business income – Experiences from certain European jurisdictions’, and Professor WSR Peter Koerver Schmidt presented on the topic of ‘Implementing Pillar Two in the EU – The Path Ahead’ at the CORIT’s Celebrational International Tax Conference on 'Past and future international tax developments'.

-

Professor Jane Bolander was interviewed by the Tax Magazine Taxo (by Karnov Group), issue no. 02/22, for an article titled ‘Ingen grund til at være jubelidiot I skatteparadis’ (EN: No reason to be a moron in tax paradise).

Research

-

Assistant Professor Jeroen Lammers — The Case for an EU Cap on Interest on Underpaid Tax : Protecting the Internal Market. Intertax, Vol. 52, No. 1, 2024.

-

Professor Peter Koerver Schmidt — Simplificering og harmonisering af selskabsbeskatningen i EU. SR SKAT 01-2024.

-

Associate Professor Michael Tell — Fradrag for endelige underskud efter SEL § 31 E : Udvalgte problemstillinger. SR-Skat, Vol. 36, Nr. 1, 2.2024.

-

Professor Jane Bolander — Forskerskatteordningen kildeskattelovens § 48 E : Fejlagtig registreret fuldt skattepligtig til Danmark. SR-Skat, Vol. 36, Nr. 3, 4.2024

-

Professor Jane Bolander — Fonde og tynd kapitalisering. SR-Skat, Vol. 36, Nr. 3, 4.2024,

-

Assistant Professor Jeroen Lammers; Tarcisio Diniz Magalhaes — Breaking the Double Tax Paradigm. World Tax Journal, Vol. 16, Nr. 1, 2024

-

Professor Peter Koerver Schmidt — Interpretation and Application of General Anti-avoidance Rules after BEPS and ATAD – Nordic Perspectives, World Tax Journal, 2024, vol. 16, issue 3.

-

Assistant Professor Jeroen Lammers — The Spirit of International Tax Law: From Fiscal Virtue to Mission-Oriented Moon-Shot. University of Amsterdam [PhD]. 2023

-

Professor Peter Koerver Schmidt —Formuebeskatning i Danmark: Aktuel debat om en gammel kending. Juristen, Vol. 105, No. 1. 2023.

-

Assistant Professor Mark Ørberg & Assistant Professor Louise Blichfeldt Fjord — Enterprise Foundations as ‘Non-profit Organizations’ Under the EU Pillar Two Directive [pre-publication]. Intertax, Vol. 51, No. 6/7. 2023.

-

Assistant Professor Louise Blichfeldt Fjord & Professor Peter Koerver Schmidt — The Digital Transformation of Tax Systems Progress, Pitfalls, and Protection in a Danish Context. Indiana Journal of Global Legal Studies, Vol. 30, No. 1. 2023.

- Professor Peter Koerver Schmidt — 'Driftsomkostninger og andre fradrag' in Christian Skovgaard Hansen; Troels Michael Lilja (ed.) Erhvervsbeskatning: Med fokus på personselskaber og virksomheds-ordningen. Djøf Forlag. 2023

- Professor Peter Koerver Schmidt — 'Internationale forhold' in Christian Skovgaard Hansen; Troels Michael Lilja (ed.) Erhvervsbeskatning: Med fokus på personselskaber og virksomheds-ordningen. Djøf Forlag. 2023

- Associate Professor Michael Tell — 'Avancebeskatning' in Christian Skovgaard Hansen; Troels Michael Lilja (ed.) Erhvervsbeskatning: Med fokus på personselskaber og virksomheds-ordningen. Djøf Forlag. 2023

- Assistant Professor Mark Ørberg & Professor WSR Peter Koerver Schmidt — Constitutional Limits on Taxation in Denmark. In: Review of International and European Economic Law, Vol. 2, No. 3, 2023

- Professor Jane Bolander — Ydelse mellem selskab og selskabsdeltager. In: Lærebog om indkomstskat. Djøf Forlag 2023

- Associate Professor Michael Tell — Udvalgte problemstillinger vedrørende SEL § 2 D. In: SR-Skat, Vol. 35, Nr. 7

- Assistant Professor Jeroen Lammers; Błażej Kuźniacki — The EU Solidarity Contribution and a More Proportional Alternative. In: Intertax, Vol. 51, Nr. 6/7, 6.2023

- Professor Jane Bolander — Skatternes opkrævning og inddrivelse In: Lærebog om indkomstskat. Djøf Forlag 2023

- Professor Jane Bolander — Skatteberegningen for personer og indkomstbegreber med relation hertil. In: Lærebog om indkomstskat. Djøf Forlag 2023

- Professor Jane Bolander — Retskilder og fortolkning. In: Lærebog om indkomstskat. Djøf Forlag 2023

- Professor Jane Bolander — Renter og kursgevinster. In: Lærebog om indkomstskat. Djøf Forlag 2023

- Professor Jane Bolander — Rekonstruktion. In: Lærebog om indkomstskat. Djøf Forlag 2023

- Professor Jane Bolander — Registreringsafgift – mandskabsvogn – leasing. In: SR-Skat, Vol. 35, Nr. 7, 11.2023

- Professor Jane Bolander — Realisationskriterier og berigtigelsesformer. In: Lærebog om indkomstskat. Djøf Forlag 2023

- Professor Jane Bolander (Redaktør) ; Liselotte Madsen (Redaktør) ; Anders Nørgaard Laursen (Redaktør) ; Inge Langhave (Redaktør) — Lærebog om indkomstskat. Djøf Forlag 2023

- Professor Jane Bolander — Kommentarer til udvalgte afgørelser. In: SR-Skat, Vol. 35, Nr. 7, 11.2023

- Professor Peter Koerver Schmidt — Internationale forhold. In: Erhvervsbeskatning: Med fokus på personselskaber og virksomhedsordningen. Djøf Forlag 2023.

- Professor Jane Bolander — Indkomstbegrebet. In: Lærebog om indkomstskat. Djøf Forlag 2023.

- Professor Jane Bolander — Gaver. In: Lærebog om indkomstskat: Djøf Forlag 2023

- Professor Jane Bolander — Forsøgs- og forskningsvirksomhed. In: SR-Skat, Vol. 35, Nr. 3, 4.2023.

- Professor Jane Bolander — Finansielle kontrakter. In: Lærebog om indkomstskat. Djøf Forlag 2023

- Professor Jane Bolander — Endeligt underskud : Selskabsskattelovens § 31 E. In: SR-Skat, Vol. 35, Nr. 3, 4.202

- Assistant Professor Mark Ørberg & Professor Peter Koerver Schmidt — Constitutional Limits on Taxation in Denmark. In: Review of International and European Economic Law, Vol. 2, Nr. 3, 202

- Professor Jane Bolander – ’Aktionærlån og maskeret udbytte – personkreds omfattet af ligningslovens § 16 E’. Taxo 2022 No. 7 Vol 34.

- Professor Jane Bolander – ’Løn i opsigelsesperiode, fratrædelsesgodtgørelse – lempelse efter ligningslovens § 33 A og dobbeltbeskatningsoverenskomst’. Taxo 2022 No. 7 Vol 34.

- Assistant Professor Louise Blichfeldt Fjord; Jakob Bundgaard – ‘Danish report: Big data and tax – domestic and international taxation of data driven business’. International Fiscal Association, Cahiers, Vol. 106 B, 2022.

- Associate Professor Michael Tell; Katja Dyppel Weber – ‘Danish report: Group approach and separate entity approach in domestic and international tax law’. International Fiscal Association, Cahiers, Vol. 106 A, 2022.

- Jacob Graff Nielsen; Professor WSR Peter Koerver Schmidt; Helle Vogt – ’Denmark’. In History and Taxation: The Dialectical Relationship between Taxation and the Political Balance of Power. IBDF. 2022.

- Professor Peter Koerver Schmidt – Direktivforslaget om global minimumsbeskatning i lyset af den fri etableringsret. SR-Skat, Vol. 34, No. 3, 4.2022.

- Professor Jane Bolander; Inge Langhave – Kryptovaluta – skatteretlige udfordringer i mødet mellem gammelt og ny. In: Festskrift till Robert Påhlsson. ed. /Nick Dimitrievski; Kjell Johansson; David Kleist; Stefan Olsson. Uppsala : Iustus förlag. 2022.

- Professor Peter Koerver Schmidt – 'Beskatning af arv og gaver med fokus på overdragelse af erhvervsvirksomhed inden for familien – forskelle i den dansk-svenske retsudvikling'. In: Festskrift till Robert Påhlsson. ed. /Nick Dimitrievski; Kjell Johansson; David Kleist; Stefan Olsson. Uppsala : Iustus förlag. 2022.

- Professor Jane Bolander – Skattepligtigt dødsbo? : Frivilling indbetaling af skat - Ydelse af gaver kort før arveladers død. SR-Skat, Vol. 34, No. 1, 2.202.

Impact

Skatterådet:

Skattelovrådet:

Professor Peter Koerver Schmidt er medlem af Skattelovrådet. Skattelovrådet fokuserer retssikkerhed, forenkling og undersøger emner efter anmodning fra skatteministeren. Professor Peter Koerver Schmidt har været medunderskriver på en rapport fra 2024 med titlen "Rapport om finansielle kryptoaktiver". Du kan læse den her.

Skatterådet

Professor Jane Bolander har siden 2020 været formand for Skatterådet. Sammen med en række af andre nøje udvalgte medlemmer, som er udvalgt af Folketinget, skatteministeren, er Skatterådets primære opgave at træffe afgørelser om bindende svar i principielle sager samt andre afgørelser om andre forhold, hvor rådet i medhør af loven er tillagt kompetence, således f.eks. befordringsgodtgørelser. Skatterådet udgiver hvert år en beretning om rådets arbejde i det foregående år. Professor Jane Bolander skriver i den forbindelse bl.a. forordene. Du kan se årsberetningerne her.

Skatterådet:

![]() Skatterådets Årsberetning 2022

Skatterådets Årsberetning 2022

Skattelovrådet:

Professor Peter Koerver Schmidt er medlem af Skattelovrådet. Skattelovrådet fokuserer retssikkerhed, forenkling og undersøger emner efter anmodning fra skatteministeren. Professor Peter Koerver Schmidt har været medunderskriver på en rapport fra 2022 med titlen, "Den tredje gruppe på arbejdsmarkedet", du kan læse mere om den her.

Grants

Funding from the FSR Foundation:

Forum for Tax Law has received funding from the FSR Foundation, which will be used to organize a research seminar in August 2024 under the auspices of the Danish-Swedish Tax Network and in connection to the cross-disciplinary research project anchored at the Department of Business Humanities and Law: 'Rethinking entrepreneurship'.

Grant for the CBS Annual International Tax Conference

The Nordic Tax Research Council generously decided to grant us funding for the annual CBS International Tax Conference on ‘Navigating Tax for Nordic-style Growth'. With the help of NTRC, we were able to host a interesting conference with acknowledged national and international speakers.

Grant by the Carlsberg Foundation:

In connection to Professor Christina Lubinski's (BHL) 20 million DKK grant by the Carlsberg Foundation for the research project 'the Entrepreneurial Age: Rethinking Entrepreneurship in Society', Professor WSR Peter Koerver Schmidt and the rest of the Forum for Tax Law aim to make a significant contribution to the project in connection to tax law.

NTRC grant:

The Nordic Tax Research Council generously decided to grant us funding for the annual CBS International Tax Conference on ‘Cross-Border Issues of Tax Policies Preventing Climate Change’. With the help of NTRC, we were able to host a prime conference with many international speakers.